Am I eligible for tax relief

Do you have to wear uniform or protective clothing for work? Do you meet the cost of washing it yourself, without any assistance from your employer? Do you pay income tax on your earnings?

If you answer yes to all of these questions you are eligible for tax relief.

Police officer

If you enter a claim with us we can also help you claim tax back on your Police Federation subscriptions. Claiming for Police Federation subscriptions can increase your tax refund by £100s.

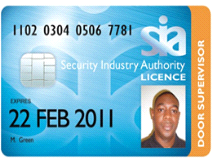

SIA registered employee

Security staff who pay their own registration to the SIA (Security Industry Authority) can claim tax back on these costs.

If you have to buy a licence for manned guarding, cash and valuables in transit, close protection, door supervision, security guarding and public space supervision (CCTV) you could increase your tax refund by £100s.

Airline or cabin crew

You can claim tax back on any visas or vaccinations you need to buy for your job. Pilots can also claim for the cost of subscriptions to BALPA (British Airline Pilots Association).

Pilots and cabin crew could be due rebates of £1,000 or more.

Gambling industry employee

You can increase the value of your claim by claiming for the cost of your Gambling Commission Personal Function Licence (PFL).

Lorry Driver

You can claim tax back on the cost of your LGV/HGV licence. You can also claim tax back on the cost of digital tachograph cards. If you’ve kept satisfactory records you can also claim back on the cost of meals on the road.

Healthcare worker

There are a huge number of different reliefs available to workers in the health industry, depending on your job type. We have a dedicated website designed just for healthcare workers.

Work in education

Teachers and lecturers can claim tax back on union subscriptions and certain compulsory registrations. PE and sports teachers can also claim tax back on the cost of sports wear they buy to teach lessons.

Purchase your own tools and equipment

Chefs, hairdressers, mechanics and anyone who purchases their own tools or protective clothing can claim tax back on those costs.

We can help you claim 20-40% of what you paid for these items back in tax.

It’s not just about uniform laundry

We’ve identified more than 30 other things that you may also be able to claim tax relief on, depending on your job.

These other reliefs can increase your tax rebate by £100s. If you enter a claim with us we can help you identify these reliefs and maximize your refund.

Here are just a few examples of the things you could be getting tax relief on.